You’ve got the right coverages in place… the foundation is solid.

But here’s what catches most business owners off guard: having the right policies doesn’t guarantee you’re getting the right protection or paying the right price.

In Part 1 of this series, we covered the five foundation coverages every business needs. Now let’s dive into the five policy mechanics that directly impact your bottom line.

1. Experience Modification Factor (XMod)

What it is: A number used to adjust your Workers’ Comp premium based on your claims history compared to others in your industry.

Why it matters: You could be overpaying by tens of thousands of dollars annually.

Your XMod starts at 1.0 (industry average). Fewer claims? It drops below 1.0, reducing your premium. More claims? It increases, and so does your cost.

The impact:

- At a 1.0 XMod: $50,000 premium (baseline)

- At a 1.3 XMod: $65,000 premium – $15,000 more per year

- At a 0.75 XMod: $37,500 premium – $12,500 annual savings

How to improve it: Focus on workplace safety, implement return-to-work programs, manage claims properly, and review your XMod annually for errors.

2. Certificate of Insurance (COI)

What it is: A COI is a document that verifies your insurance coverage and lists your policy types, limits, and key endorsements.

Why it matters: While COIs themselves don’t cost extra (they’re typically included with your policy), what the COI requires can impact your premium.

When COIs impact your premium:

Sometimes your existing limits or endorsements don’t meet a contract’s requirements, and you may need to:

- Increase liability limits

- Add Additional Insured endorsements

- Add a Waiver of Subrogation

- Add Hired & Non-Owned Auto

These additions can increase your premium.

Common COI requirements include:

- General Liability: $1M per occurrence / $2M aggregate

- Commercial Auto: $1M combined single limit

- Additional Insured status

- Waiver of Subrogation

Pro tip: Keep digital COIs organized and accessible. Delays can cost you contracts – and missing requirements can cost you money.

3. Named Insured vs. Additional Insured

What it is: The Named Insured is the person or business that owns the policy and receives full coverage. An Additional Insured is a third party added to your policy for limited protection – usually because a contract requires it.

Why it matters: Adding someone as an Additional Insured can increase your premium and shift claim responsibility to your policy. For example, if a subcontractor adds a general contractor as an Additional Insured and a claim occurs, the subcontractor’s policy pays first – not the GC’s. This protects the other party but can drive up your future insurance costs.

Where this comes up:

- Landlords requiring protection for incidents on your premises

- General contractors wanting coverage for your work at their job site

Bottom line:

Misunderstanding who needs to be named (and how) can leave you under-covered or paying more than necessary. Getting this right protects your contracts and your bottom line.

4. Endorsements

What it is: Add-ons or modifications that tailor your policy to your specific needs.

Why it matters: Endorsements expand coverage or help you meet contract requirements – often at an additional cost. Missing a required endorsement can lead to denied claims, contract delays, or even losing the job entirely.

Common endorsements:

- Hired & Non-Owned Auto: Covers employees using personal vehicles for business.

- Employee Dishonesty: Protects against theft or fraud by employees.

- Equipment-related endorsements: Such as Equipment Breakdown or Equipment Floaters, which protect against mechanical or electrical failures and cover tools or equipment that move between locations or job sites.

- Waiver of Subrogation: Prevents your insurer from suing another party to recover costs. Often required in contracts.

- Additional Insured – Per-Contract or Blanket: Per-contract endorsements add each Additional Insured individually as required by a specific agreement, while blanket endorsements automatically extend Additional Insured status to any party required by written contract, making compliance faster and simpler.

Example: You hire a subcontractor. They accidentally cause damage on the job. Because you required them to add your business as an Additional Insured, their insurance helps protect you.

5. Exclusions

What it is: Specific situations or losses your policy won’t cover.

Why it matters: It’s what’s not included that gets you in trouble. Most business owners never read their exclusions until a claim is denied.

Common exclusions:

- Pollution: Most General Liability policies exclude pollution-related claims.

- Solution: Pollution Liability Policy

- Professional errors: General Liability doesn’t cover mistakes in professional service.

- Solution: Errors & Omissions Policy (E & O)

- Cyber events: Property insurance doesn’t cover data breaches or ransomware.

- Solution: Cyber Liability Policy

- Employee injuries: General Liability excludes these.

- Solution: Workers’ Compensation Insurance

- Flood damage: Standard property insurance excludes floods.

- Solution: Separate flood coverage.

Example: A restaurant suffers storm water damage. The owner assumes property insurance covers it, but the policy excludes flood damage. The $60,000 repair bill comes out of pocket.

How to protect yourself: Read your policy declarations, ask your agent about major exclusions, and fill gaps with separate policies or endorsements.

What’s Next: Specialized Coverage

You now understand foundation coverages (Part 1) and policy mechanics (this article). But as your business grows, the foundation isn’t enough.

In Part 3, we’ll cover specialized protections:

- Professional Liability

- Cyber Liability

- Employment Practices Liability

- Directors & Officers Insurance

- And more specialized coverages that fill critical gaps

Ready to Optimize Your Insurance Program?

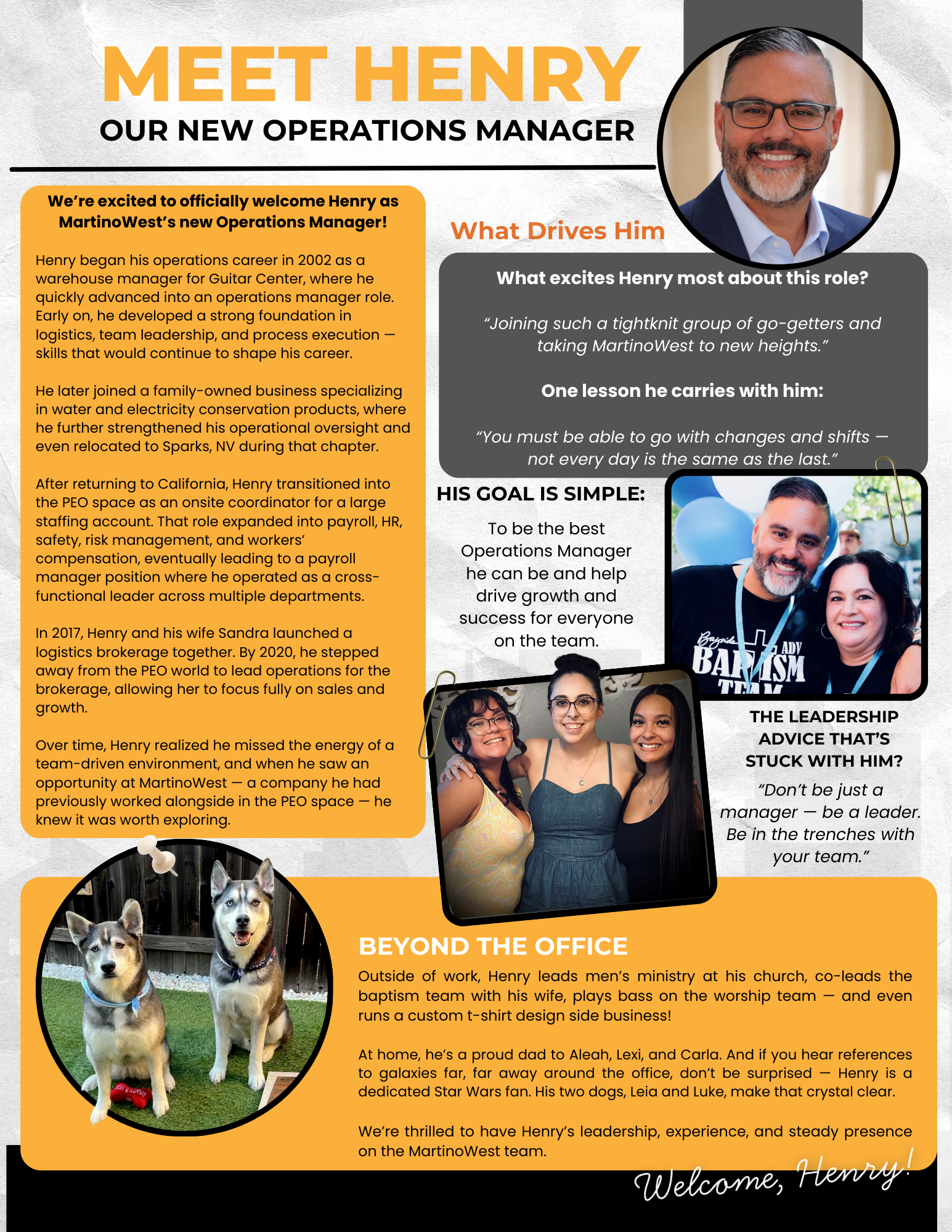

At MartinoWest, we help business owners understand not just what they’re buying, but how each part of their policy affects their costs and their coverage.

Let’s talk about your policy mechanics:

- What’s your XMod costing you?

- Are your endorsements up to date?

- Do you understand your exclusions?

Schedule a policy review and we’ll help you reduce costs, ensure your policy works for you, and build a clear strategy for growth.

MartinoWest: Simplifying insurance so business owners can focus on what they do best – building and growing their business.

Get a Qoute

Whether you need PEO support, business insurance, or streamlined payroll, we'll bundle the right solutions for your business. Get a personalized quote today.

Harper

Speak to Harper 24/7

Microphone ready

Start your custom insurance quote

Instant answers to your insurance questions

Schedule appointments or follow-ups

Professional Employer Organizations

Payroll, benefits, HR, workers' compensation, and compliance are seamlessly bundled through reliable PEO partners, empowering your business to achieve more with fewer resources.

Payroll+ Services

Payroll, HR, compliance, and back-office support are managed by a single team, allowing you to stop juggling multiple vendors and concentrate on driving growth.

Commercial Insurance

At MartinoWest, we craft comprehensive commercial coverage that protects your assets, employees, and bottom line without the corporate runaround.

Recent Posts