When was the last time you actually understood your insurance renewal documents?

If you’re like most business owners, insurance feels like something you have to deal with rather than something that genuinely protects your livelihood. The jargon is confusing, the policies are dense, and decoding insurance terminology isn’t exactly at the top of your priority list when you’re trying to run a company.

But here’s the thing: getting your foundation right from the start can save you from catastrophic financial losses down the road.

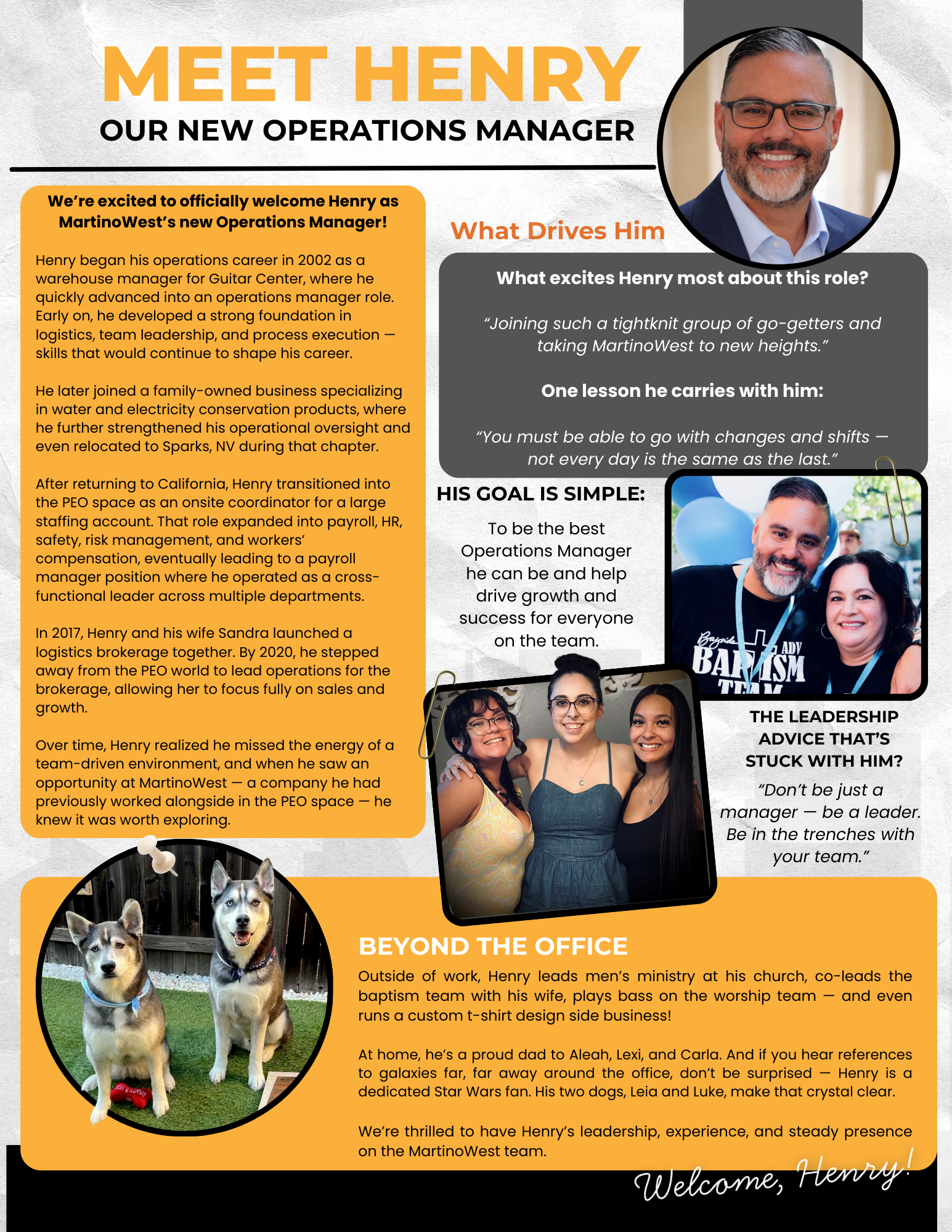

At MartinoWest, we believe in transparency and education. So let’s cut through the confusion and break down the five essential coverages that form the backbone of nearly every commercial insurance program.

1. General Liability Insurance (GL)

What it is: Protection against claims of bodily injury, property damage, and personal injury that occur on your premises, on job sites, or on someone else’s property as a result of your business operations.

Why it matters: This is your foundational coverage. Without it, a single lawsuit could wipe out years of hard work.

Real-world example: A marketing consultant accidentally spills coffee on a client’s laptop during a presentation, ruining the device. General Liability would cover the cost of replacing the laptop, but not the data loss. Common examples of GL claims include product-related injuries or customer slip-and-fall accidents.

Who needs it: Every business that interacts with clients, customers, or visitors – or manufactures a tangible product that could cause injury or property damage.

2. Property Insurance

What it is: Coverage that protects your business’s physical assets – building, equipment, furniture, and inventory – from damage caused by fire, theft, vandalism, or other covered events.

Why it matters: Without property coverage, a fire or break-in could mean starting from scratch financially and operationally.

Real-world example: A retail shop suffers fire damage from the building next door. Smoke and water damage destroys $45,000 in inventory and fixtures. Property insurance covers replacement costs so the business can reopen without depleting savings.

What’s covered: Buildings you own, equipment, computers, inventory, leasehold improvements (renovations to leased space), and signage. It may also include loss of use coverage, which reimburses your business for downtime while repairs are made.

Critical note: Stand-alone commercial property insurance typically covers only the building and fixtures attached to it (such as HVAC systems or built-in cabinetry) and protection is usually limited to specific perils like fire, theft, or vandalism. Flood or earthquake coverage must be purchased separately.

3. Workers’ Compensation Insurance

What it is: Coverage that pays for medical expenses and lost wages when an employee is injured or becomes ill during the course of their employment.

Why it matters: It’s legally required in most states as soon as you hire your first employee. Without it, an injured worker can sue your business directly – and one claim could easily reach $100,000, $200,000, or even $1 million. Could your business absorb that? Workers’ Comp not only pays for the employee’s medical expenses and lost wages, but it also provides legal defense for the employer and, in most cases, prevents employees from suing you for the injury.

Real-world example: A warehouse worker strains their back lifting a heavy box and needs three months of physical therapy. Workers’ Comp pays for all medical treatment and a portion of their wages. Without it, your business could face a lawsuit plus tens of thousands in medical costs.

When you need it: The moment you hire your first employee – even part-time.

4. Commercial Auto Insurance

What it is: Insurance for vehicles used in your business, covering liability, property damage, and medical expenses.

Why it matters: Personal auto policies often exclude business use. If an accident happens while a vehicle is being used for business purposes, your personal insurer could deny the claim entirely.

Real-world example: Susie, an administrative assistant, drives her personal vehicle to the bank to make a company deposit and gets into an accident. Without Hired and Non-Owned Auto (HNOA) coverage, the employer could be liable for vehicle damage and face a Workers’ Comp claim for Susie’s injuries.

What’s covered: Company-owned vehicles for liability, physical damage, and medical payments. Coverage for rentals or employee-owned vehicles depends on the coverages purchased and must be added through HNOA coverage.

5. Business Owner’s Policy (BOP)

What it is: A bundle of several essential coverages (typically General Liability and Property Insurance) into a single, cost-effective package. It often includes protection for business personal property and business interruption (coverage for lost income and expenses if your business can’t operate after a covered event).

Why it matters: A BOP simplifies your insurance management and saves money by combining key protections most small and midsize businesses need.

Real-world example: A coffee shop owner needs liability and property coverage. Instead of buying two separate policies at $3,500 and $2,800, they get a BOP for $5,200 – saving $1,100 annually while getting business interruption included.

Who should consider it: Retailers, restaurants, small offices, consultants, and service-based businesses that need a straightforward, affordable way to secure foundational protection. Manufacturing, construction, and specialized industries may require more customized policies.

What Comes Next

These five coverages protect your business from the most common risks. But understanding how your policies work (and what influences your costs) is just as important.

In Part 2, we’ll break down the policy mechanics that determine what you pay and what gets covered:

- Experience Modification Factor (why it could be costing you thousands)

- Certificates of Insurance (proof of coverage and compliance requirements)

- Named Insured vs. Additional Insured (why it matters for contracts)

- Endorsements (customizing coverage as you grow, including Waivers of Subrogation and Blanket or Per-Contract options)

- Exclusions (gaps that get business owners in trouble)

In Part 3, we’ll cover specialized coverages like Cyber Liability, Professional Liability, and EPLI – protections that address modern risks the foundation policies don’t cover.

Ready to Build Your Insurance Foundation Right?

At MartinoWest, we educate, advise, and partner with business owners to build smart protection strategies.

Let’s start with a conversation:

- Do you have all five foundation coverages in place?

- Are your coverage limits adequate?

- Are you paying for coverage you don’t need or missing coverage you do?

We’ll ensure you have the essentials, identify gaps, and find cost-effective solutions that don’t sacrifice protection.

Because insurance shouldn’t create confusion. It should create confidence.

MartinoWest: Simplifying insurance so business owners can focus on what they do best – building and growing their business.

Get a Qoute

Whether you need PEO support, business insurance, or streamlined payroll, we'll bundle the right solutions for your business. Get a personalized quote today.

Harper

Speak to Harper 24/7

Microphone ready

Start your custom insurance quote

Instant answers to your insurance questions

Schedule appointments or follow-ups

Professional Employer Organizations

Payroll, benefits, HR, workers' compensation, and compliance are seamlessly bundled through reliable PEO partners, empowering your business to achieve more with fewer resources.

Payroll+ Services

Payroll, HR, compliance, and back-office support are managed by a single team, allowing you to stop juggling multiple vendors and concentrate on driving growth.

Commercial Insurance

At MartinoWest, we craft comprehensive commercial coverage that protects your assets, employees, and bottom line without the corporate runaround.

Recent Posts